By Jason Bogniard, MBA, ASA, CVA, EA | Robert Jackson, CPA, MT | Andrew Adolph

There can be significant income tax advantages to donating privately held stock or units to your favorite qualified charity, rather than charitable gifts of cash.

A business owner with an interest in a non-publicly traded C- or S-Corporation, Limited Liability Company (LLC) or Partnership very likely has a low-cost basis in their investment, and potentially substantial value appreciation in their business interest. If, and when, the ownership interest is sold, a sizeable Federal capital gain tax, along with state income tax on the gain depending on the state of residency tax laws, will come due. Donations of privately held business interests can provide powerful personal income tax deductions, and at the same time, avoid capital gains taxes related to the portion of the business interest gifted to charity. The result often is that the charity receiving the donation will receive even more from the donor, as compared to a situation whereby the business owner sells their ownership interest, pays capital gain tax and remits a cash donation to a charity, or a donor advised fund established by business owner. It should be noted that gifts of C-Corporation stock have far fewer tax considerations for both the donor and donee than gifts of S Corporation stock or units in an LLC or partnership. The analysis of these issues is beyond the scope of this discussion, but we briefly discuss these traps later in the article. Needless to say, tax consultation and planning is required to ensure the donation of a privately held business interest has its intended effect for tax purposes.

The example below illustrates the power of this tax planning strategy. Assume a privately held C Corporation has a fair market value of $10million. The business owner with charitable interests chooses to donate to a charity 10% of the outstanding shares of the company to the qualified charity, a donation which represents $1million to the charity receiving the gift ($10million value times 10% ownership interest gifted). The gift to the charity is being made prior to any binding agreement to sell the shares. Further assume that later that same year, the owner and the charity sell the shares for $10million.

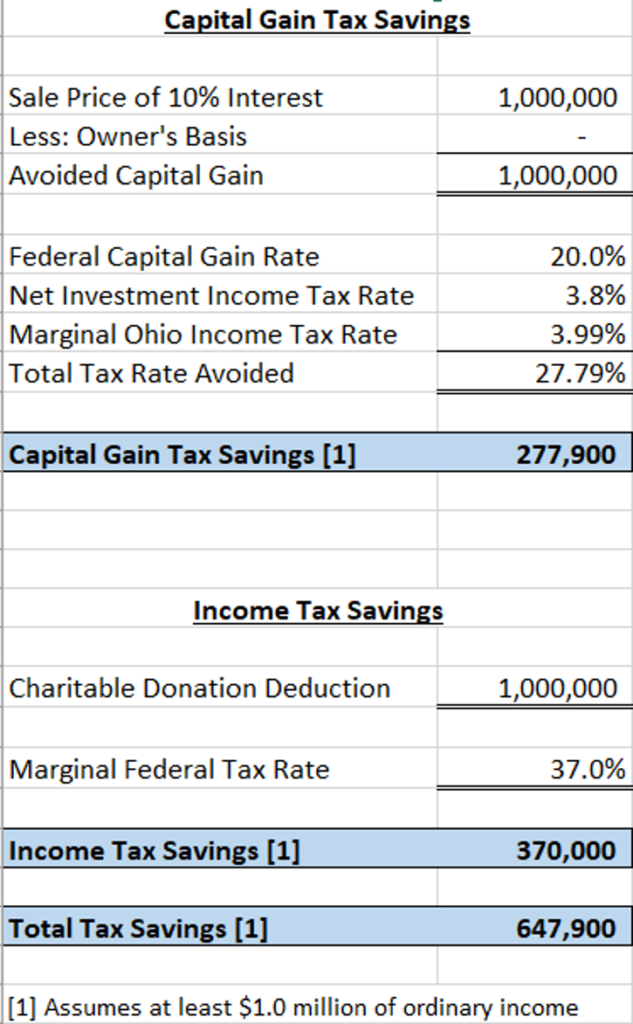

If the business owner has no basis in their investment, then the capital gain on the $1million associated with the 10% ownership interest donated is completely avoided. When properly documented through a “qualified appraisal,” the business owner receives an income tax deduction on Schedule A of their personal income tax return (Form 1040) equal to the fair market value of the donated stock of $1million. If a sale of the business occurs at $10million, the charity receives $1 million of cash sale proceeds, and as a qualified charity, has no income tax obligations related to its share of the sale proceeds. In this example the total tax savings are $647,900 on a $1 million donation as follows:

To unlock this powerful tax planning tool, a taxpayer must comply with Internal Revenue Service (IRS) rules for documenting and reporting the value of the donated privately held stock interest. All gifts above $5,000, excluding cash donations, are required to have a “qualified appraisal” from a “qualified appraiser.” The IRS defines a qualified appraiser as an individual with verifiable education and experience in valuing the privately held stock interest and is compensated for their services. To be a qualified appraisal, some of the important items the appraisal report must reflect include:

- Is dated effective no earlier than 60 days before the date of contribution and no later than the day of contribution

- The Fair Market Value of the privately held stock interest

- Describes the terms of any agreement related to the use, sale or other dispensation of the privately held stock

- Made, signed and dated by a qualified appraiser

- In accordance with generally accepted appraisal standards, as defined by Treasury Regulation 1.170A-17(a)

Additionally, the taxpayer is required to file form 8283, and a copy of the appraisal with their individual income tax return, to support the deduction for a donated privately held business interest.

As with employing all tax planning strategies, taxpayers are wise to seek professional legal, tax and in this case, business valuation expertise. The example provided above is for illustration purposes only. Each taxpayer has unique income and deduction situations, and actual tax implications may differ from those presented above. For example, non-cash gifts of appreciated capital gain property normally are limited to 30% of the taxpayer’s adjusted gross income.

As indicated earlier, there are additional tax traps for donors worth mentioning –

- Donations of LLC or partnership units may result in a taxable sale if the donor is relieved of any liabilities at the time of donation (which is usually the case).

- All donations of LLC or partnership units or S Corporation stock must be reduced by any ordinary income that would have resulted if the entity sold its assets. For instance, a reduction would occur if either of these entity types held inventory at the time of sale.

- Donations of LLC or partnership units, or privately held C Corporation or S Corporation stock to a “private nonoperating foundation” are limited to the donor’s basis, which usually eliminates such gifts from being donated due to a lack of tax benefits.

Finally, the charitable organization itself has several considerations to make when accepting donations of closely held business interests, not the least of which is Unrelated Business Income Tax (UBIT) rules, which require a tax-exempt organization to pay income tax related to business income that is not substantially related to the organization’s tax-exempt purpose. A coordinated approach between the tax-exempt organization, the donor, a competent tax professional and a business valuation expert are required to ensure avoiding any income tax pitfalls. Don’t have a favorite charity in mind as of yet? No problem. An individual can create a donor-advised fund, which are 501 (c)(3) public charities eligible to accept gifts of certain privately held interests. While donor-advised funds may create additional tax challenges for both the donor and donee, they can still prove useful in certain situations. A discussion of the additional tax challenges and requirements for establishing and donating to donor-advised funds is a separate topic to discuss with a trusted team of financial advisors.