By Matt Silla, ASA, CFA | Principal

October 12, 2021

The U.S. House of Representatives recently released a bill impacting both personal and corporate taxes for those above certain income levels. While the ultimate outcome of what will become law is unknown, business owners should begin to assess potential changes and what they could mean to existing succession plans, especially for the proposed increases to capital gains rates.

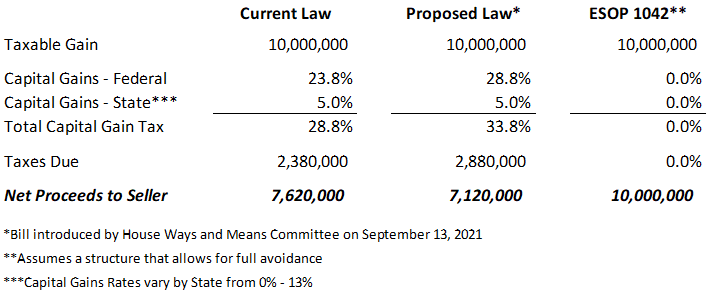

For business owners nearing retirement or entering the next phase in their legacy, selling their business to their employees as part of an employee stock ownership plan (ESOP) in a 1042 transaction may be more attractive with the proposed tax changes as capital gain rates are likely to increase. However, capital gains taxes are certainly not the only consideration in determining the feasibility of an ESOP for a selling business owner. Per the Internal Revenue Code (IRC), a 1042 transaction would allow for eligible shareholders to defer the capital gains tax on eligible stock sold to an ESOP if the proceeds of the sale are reinvested in a qualified replacement property (QPR). Taxes wouldn’t be due until the taxpayer disposed the QRP and if structured property could allow for the avoidance of capital gains taxes all together. It should be noted that a tax proposal introduced by the Biden administration would effectively eliminate the entire avoidance and make a 1042 transaction simply a deferral of capital gains. In order to qualify for a 1042 transaction a business must be a C-Corporation or convert to a C-Corporation during the ESOP transaction process. ESOP 1042 transactions haven’t been as popular recently with lower capital gains rates. However, with capital gains rates expected to increase for taxpayers in the top bracket, the ESOP 1042 transaction may become more attractive. A simplified example of the net proceeds a seller would receive based on current law, proposed law and in an ESOP 1042 transaction are included below:

At this time, we must wait for further developments of the current tax plan being negotiated by Congress. However, if you’re interested in learning more about an ESOP, download our ESOP e-book.

Subscribe to receive our blog and other interest based updates.