By Jason Bogniard, MBA, ASA, CVA, EA | Principal, Business Valuation

The swift and sudden economic damage caused by the COVID-19 pandemic have left many of us stunned. In such a state, it’s easy to hunker down and miss opportunities, including estate planning and related gift and estate tax savings opportunities. In addition to the many millions left unemployed in a short matter of weeks, one of the most obvious early casualties in the COVID-19 fallout is the dramatic decline in the value of investment holdings. Herein lies a powerful estate planning opportunity not to be missed by those who already have begun or are considering estate gift tax strategies.

A common estate planning vehicle for accumulated family wealth is a limited partnership or limited liability company, formed by families to hold marketable investments, real estate, family businesses, and other assets with the potential to appreciate in the future. Generically, these investment vehicles can be referred to as family limited partnerships (FLP), which are nothing more than a holding company owned by two or more family members to provide protection against creditors and reduce gift and estate taxes while ensuring family held assets stay within the family.

When structured properly by legal counsel, FLPs have contractual agreements in place which dictate how management decisions will be made within the family and often times, restrict a partner or member’s ability to transfer their interest outside the family, along with other restrictions. These restrictions, when combined with the unique investment characteristics of the underlying assets held, are the beginning point for an accredited business appraiser to develop discounts for lack of control and lack of marketability in a fair market valuation of the FLP. These discounts for lack of control and marketable can collectively range from 10% to in excess of 40% of the underlying FLP asset values. These valuation discounts allow senior generations of the family group to gift interests in the FLP at significantly lower values than the collective controlling interest value of the FLP. This has been a long establish gift and estate tax minimizing strategy for decades and when done correctly is acceptable to the IRS.

An unmarried individual can gift up to $15,000 of cash or fair market value of other assets for the year 2020 to any person without recognizing a taxable gift. The annual gift tax exclusion amount is double to $30,000 for married persons electing to “split” the gift on their respective gift tax returns. The current decline in all asset values, not just one’s stock portfolio, provides a powerful estate planning opportunity in the form of an additional market value discount, in addition to the well established and IRS accepted valuation discounts for lack of control and marketability. Let’s call this an additional discount a COVID-19 market discount, and if you own any sort of salable asset you caught this bug in the form of reduced investment values. We all collectively hope this reduced wealth is temporary, but while its present, gift and estate tax planning opportunities abound.

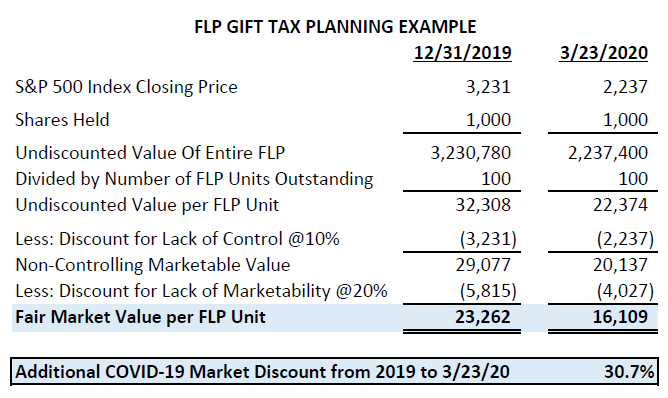

The following example of an FLP holding 1,000 shares in an S&P 500 Index Fund illustrates the magnitude of the COVID-19 market discount from the end of 2019 to a recent trading day of March 23, 2020.

Although the above example relates to publicly traded securities, a similar result is likely for FLPs holding real estate and privately held companies. The bottom line is during this time of great uncertainty, all asset classes (excluding toilet paper and hand sanitizer) have declined in value and allow more potentially appreciating assets to be gifted from senior generations to younger generations and thereby escaping gift and future estate taxes.

Meeting face to face with your attorney, accountant, and business appraiser may not be at the top of your list of things to do at the moment. The good news is that all estate planning, from the formation of an FLP to the appraisal of a non-controlling interest in it, can be done from the convenience of one’s home with the aid of technology. Additionally, the decision to make a gift can be made now and documented in the form of an accredited business valuation and gift tax return many weeks or months after that gifting decision was made. Under current tax law, a gift of property made during 2020 does not have to be reported to the IRS until October 15, 2021, if one takes advantage of all applicable individual income tax extensions.

If gifting appreciating assets to family members and other individuals was already part of your estate planning, now is a perfect time to take continued action on that plan.